“I saw on the news that ‘all cabinet ministers are being reappointed,’ does that mean nothing is going to change?” “What happened to the talk about increasing my take-home pay?”

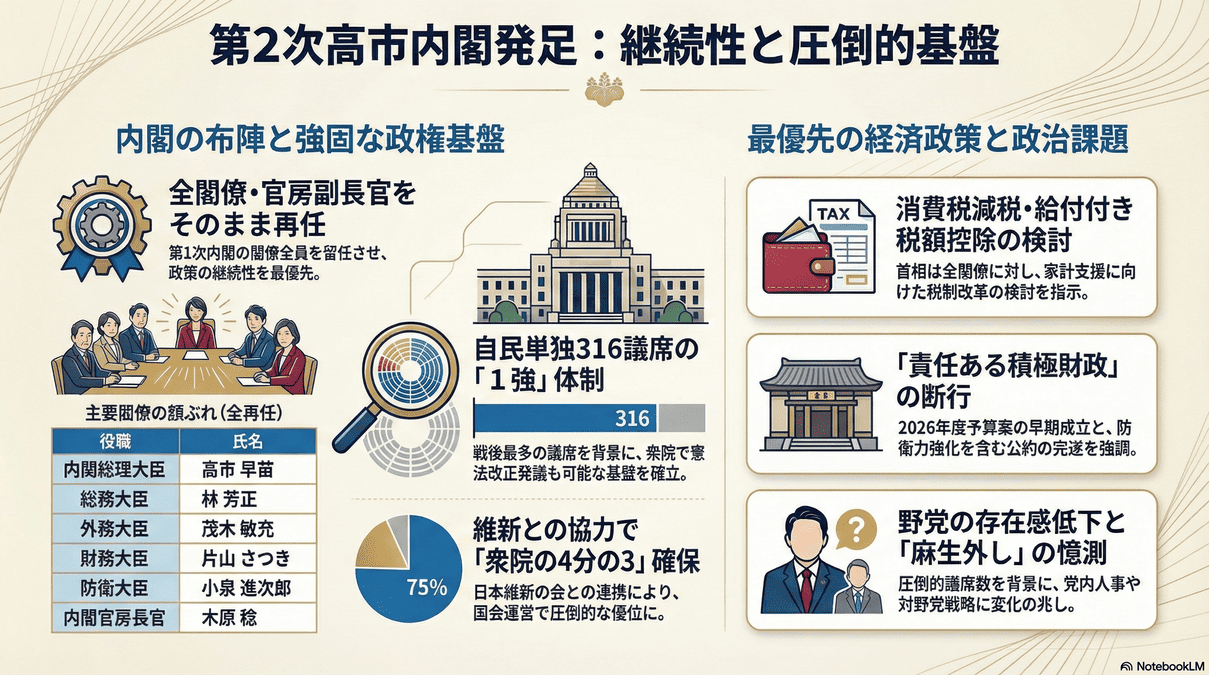

On February 18, 2026, the Second Takaichi Cabinet was inaugurated. Many may feel it “lacks freshness” due to the unchanged lineup. However, the audit conclusion of the Ouchics Research Office is the opposite. This is an extremely practical battle stance designed to “execute tax cuts and cash benefits at the fastest possible speed.”

In this article, we will not discuss the “political situation” reported by major media outlets, but rather thoroughly audit when and how the “Consumption Tax Reduction” and “Refundable Tax Credits” (benefits-attached tax deductions), which Prime Minister Takaichi instructed all ministers to work on, will reach your household budget.

Principle: The reappointment of all ministers is a strategy to enter budget deliberations with “zero handover time.” Immediately after taking office, the Prime Minister instructed all ministers to examine “Consumption Tax Reductions” and “Refundable Tax Credits.”

Caution: While the ruling party’s overwhelming majority (352 seats) accelerates decision-making speed, it also creates the risk of a “decision-first model” where it is difficult to apply the brakes on discussions.

Chapter 1: Why “Reappoint All Ministers”? Auditing the Meaning for Households

ミントちゃん

ミントちゃんAn Attitude Prioritizing Speed Seen in “No Individual Roll Call”

At the press conference announcing the cabinet roster on February 18, Chief Cabinet Secretary Kihara took an unusual approach. He omitted the usual reading of each individual’s name, finishing with a single phrase: “All members are reappointed.”

- Traditional Custom: Reading names one by one, spending time on ceremony.

- This Time’s Response: Omitted reading. Immediately moved to deliberations on the supplementary budget and main budget.

This is not merely about saving time. It can be read as a strong statement of intent by the administration: “Practicality over ceremony” and “Realizing pledges (tax cuts/benefits) as soon as possible.” According to reports by the Mainichi Shimbun, backed by the “power of numbers” with a combined 352 seats for the LDP and Ishin, Prime Minister Takaichi is putting pressure on executives, saying, “We will do everything written in the platform.”

The Aim is Enactment of the “FY2026 Budget Proposal” Within the Fiscal Year

According to Jiji Press, Prime Minister Takaichi has shown a strong desire to enact the “FY2026 Budget Proposal,” which has been delayed due to the election, within the fiscal year (by the end of March). If cabinet ministers had been replaced, new ministers would have needed time to memorize their parliamentary answers, and the budget’s enactment would certainly have slipped to April or later.

In other words, reappointing all ministers was “the only choice to deliver new support measures to everyone’s lives starting in April.”

Chapter 2: [Most Important] When Will Zero Consumption Tax and Benefits Arrive?

クロマル

クロマルTwo Major Points of the Prime Minister’s Instructions

According to NHK News, Prime Minister Takaichi formally instructed the reappointed cabinet ministers to consider the following two points.

- 1. Consumption Tax Reduction

-

Concretization of the Lower House election pledge to “reduce consumption tax on food and beverages, etc., to zero for two years.”

- 2. Refundable Tax Credit (Benefit-attached Tax Deduction)

-

A mechanism to provide cash benefits centered on low-income groups while reducing the tax burden, in order to bridge the time lag until the tax cut is implemented.

Estimated Timeline (Audit Prediction)

Calculating backward from currently available information (goal of budget enactment within the fiscal year, special Diet session until July 17), the schedule affecting household budgets is surmised as follows.

[Now to End of March] Budget Deliberation & Enactment

The biggest focal point is whether “cash benefits” and “tax cut preparation costs” will be included in the FY2026 budget proposal. If enacted within the fiscal year, the execution budget will be secured.

[April to June] System Design & Legal Amendments

Changing the consumption tax rate requires system modifications. During this period, “Refundable Tax Credits” may be implemented in advance.

[Summer Onwards] Start of Zero Consumption Tax?

It is highly probable that the suspension of consumption tax on food and beverages will start as per the pledge as soon as system compatibility is ready.

Chapter 3: Risk Audit – What Will “Takaichi Dominance” Bring?

プラチナちゃん

プラチナちゃんThe Risk of Decisions Being “Too Fast”

As noted in the Mainichi Shimbun article, a “giant ruling coalition” with a combined 352 seats for the LDP and Ishin has been born. This means they have the power to pass bills over the opposition of other parties.

- Pros: Support measures such as benefits and tax cuts will be decided and executed at unprecedented speed.

- Cons (Risks): There is a possibility that institutional flaws (such as households falling through the cracks) may proceed without sufficient review.

Additionally, since “responsible proactive fiscal policy” is being advocated, attention must be paid to the risk of rising interest rates and accelerating inflation due to concerns over fiscal discipline (side effects of the so-called “Takaichi Trade”).

Frequently Asked Questions (FAQ)

- When does the Zero Consumption Tax start?

-

It is not determined at this time; it is at the stage where the Prime Minister has issued “instructions for consideration.” Considering the system modification period, the earliest implementation would be in a few months, or “cash benefits” may precede it as a stopgap measure. Keep an eye on future Diet deliberations.

- Who can receive the benefits?

-

This is being considered in the context of “Refundable Tax Credits.” Generally, it will center on low-income groups, but details will be decided during the deliberation process for the FY2026 budget proposal.

- Will electricity subsidies continue?

-

Although not explicitly stated in this news, Prime Minister Takaichi emphasizes “energy self-sufficiency” and “economic security.” From the perspective of household budget defense, it is wise not to rely solely on subsidies but to continue implementing power-saving and self-defense measures (see Category 1).

Summary: What You Should Do Now to Defend Your Household Budget

The inauguration of the Second Takaichi Cabinet is not a political show but “a signal that your household budget environment will change drastically.” The speed created by reappointing all ministers will directly hit our lives, for better or worse.

[Within 5 Minutes]

Check the registration status of your My Number Card PIN and Public Money Receiving Account. (To apply immediately when benefits are decided)

[Within 1 Week]

Review your current subscriptions and fixed costs. Build a buffer to defend against inflation on your own during the few months until “Zero Consumption Tax” begins.

[Within 1 Month]

Be sure to check the news on the enactment of the FY2026 budget proposal. The moment of “decision” is the starting line for using the system.

The Ouchics Research Office will continue to audit the impact of “Takaichi Cabinet policy decisions” on household budgets in real-time through Breaking News (Category 5) and Countermeasures (Category 3).

Reference Links (Primary Sources & Reports)

- [List] 2nd Takaichi Cabinet Personnel: All Ministers Reappointed | NHK News

- 2nd Takaichi Cabinet Launched, All Ministers Reappointed, Special Diet Session Convened: Jiji Press

- [Breaking News] 2nd Takaichi Cabinet to Start… Announcement that All Ministers are Reappointed | FNN Prime Online

- Prime Minister’s Office: List of Ministers, etc., of the 2nd Takaichi Cabinet

- Prime Minister’s Office: Organization & System

Comments